Final Guard Mutual: Final Expense Insurance

Protect Your Loved Ones with Final Expense Insurance

"Affordable Final Expense Insurance: Plan Today For Tomorrow"

What Is Final Expense Insurance?

Final Expense Insurance, is a type of life insurance designed to cover the costs associated with end-of-life expenses. This policy ensures that loved ones are not burdened with financial stress during a difficult time. It typically offers smaller coverage amounts compared to traditional life insurance, usually ranging from $5,000 to $50,000, and is often marketed to seniors or individuals planning for funeral and burial costs.

Final Expense Insurance is ideal for those who want an affordable and straightforward way to ensure their final arrangements are handled without imposing financial hardship on their family.

FAQ about Final Expense Insurance

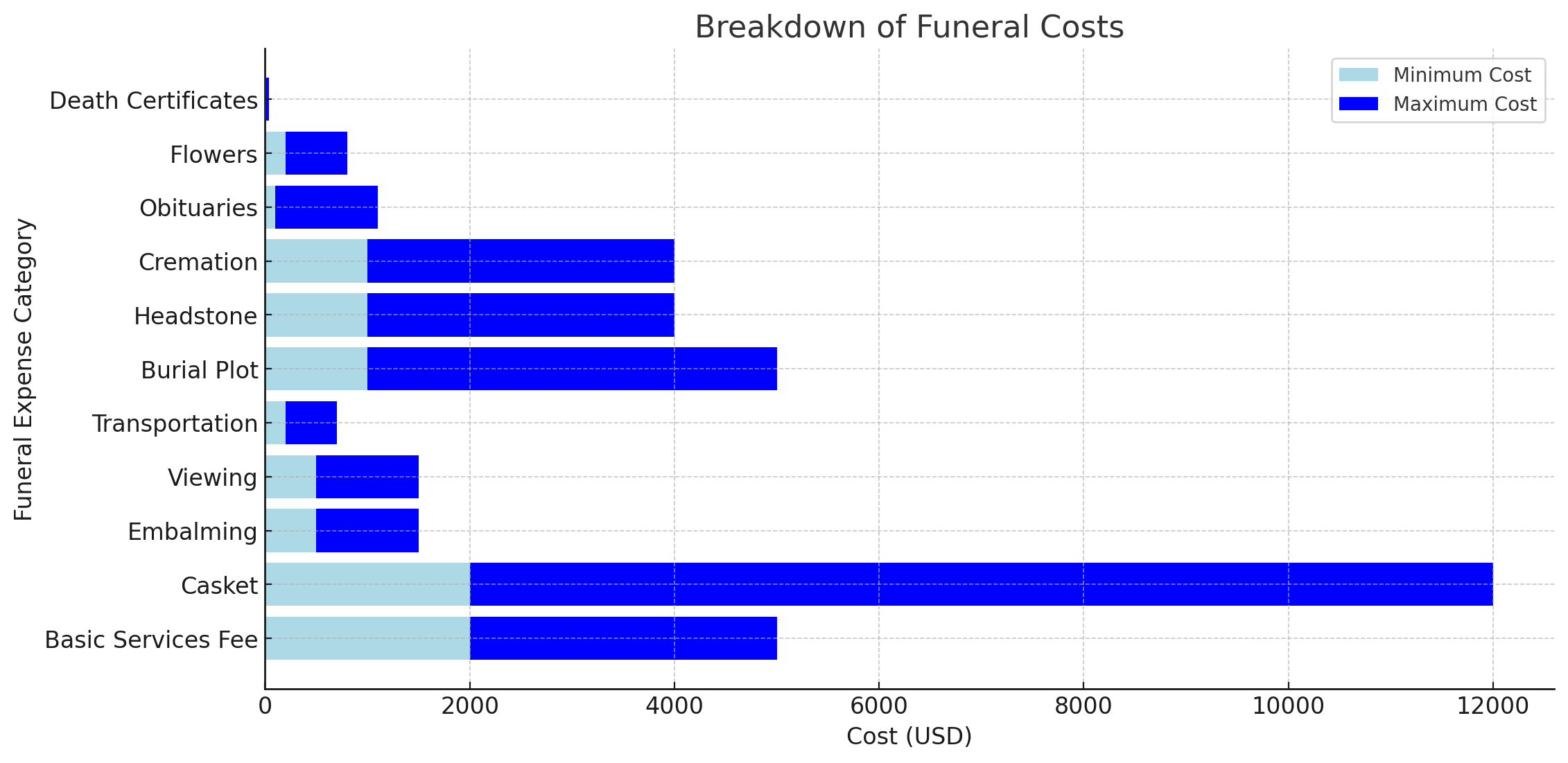

Final expense insurance is designed to cover costs associated with end-of-life expenses, such as funeral and burial services, cremation, and other related bills. It is often chosen for its affordability, simplicity, and focus on providing peace of mind for individuals and their familie

Unlike traditional life insurance, which often has higher coverage amounts and broader purposes, Final Expense Insurance typically has a smaller coverage amount (e.g., $5,000–$50,000) and is specifically intended for end-of-life expenses.

Most insurers offer this policy to individuals aged 50 to 85. Eligibility may vary depending on the provider and the specific policy.

Many Final Expense Insurance policies are “simplified issue” or “guaranteed issue,” meaning they do not require a medical exam. Instead, applicants may need to answer a few health-related questions.

Accordion Content

- Affordable premiums tailored for smaller coverage amounts

- Easy qualification process

- Provides peace of mind to ensure loved ones are not financially burdened

- Cash benefit can be used for any purpose, including funeral costs, outstanding bills, or debts

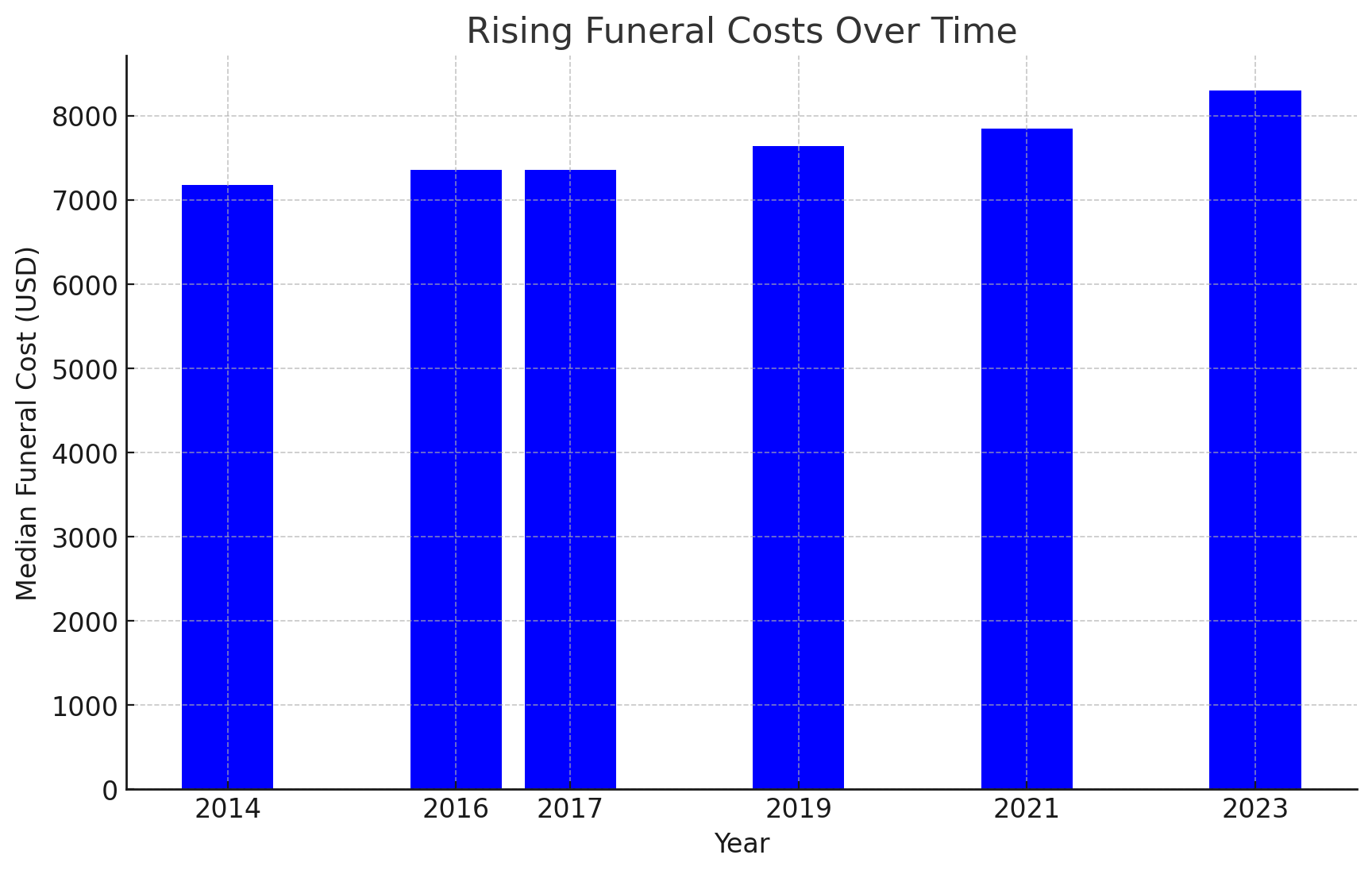

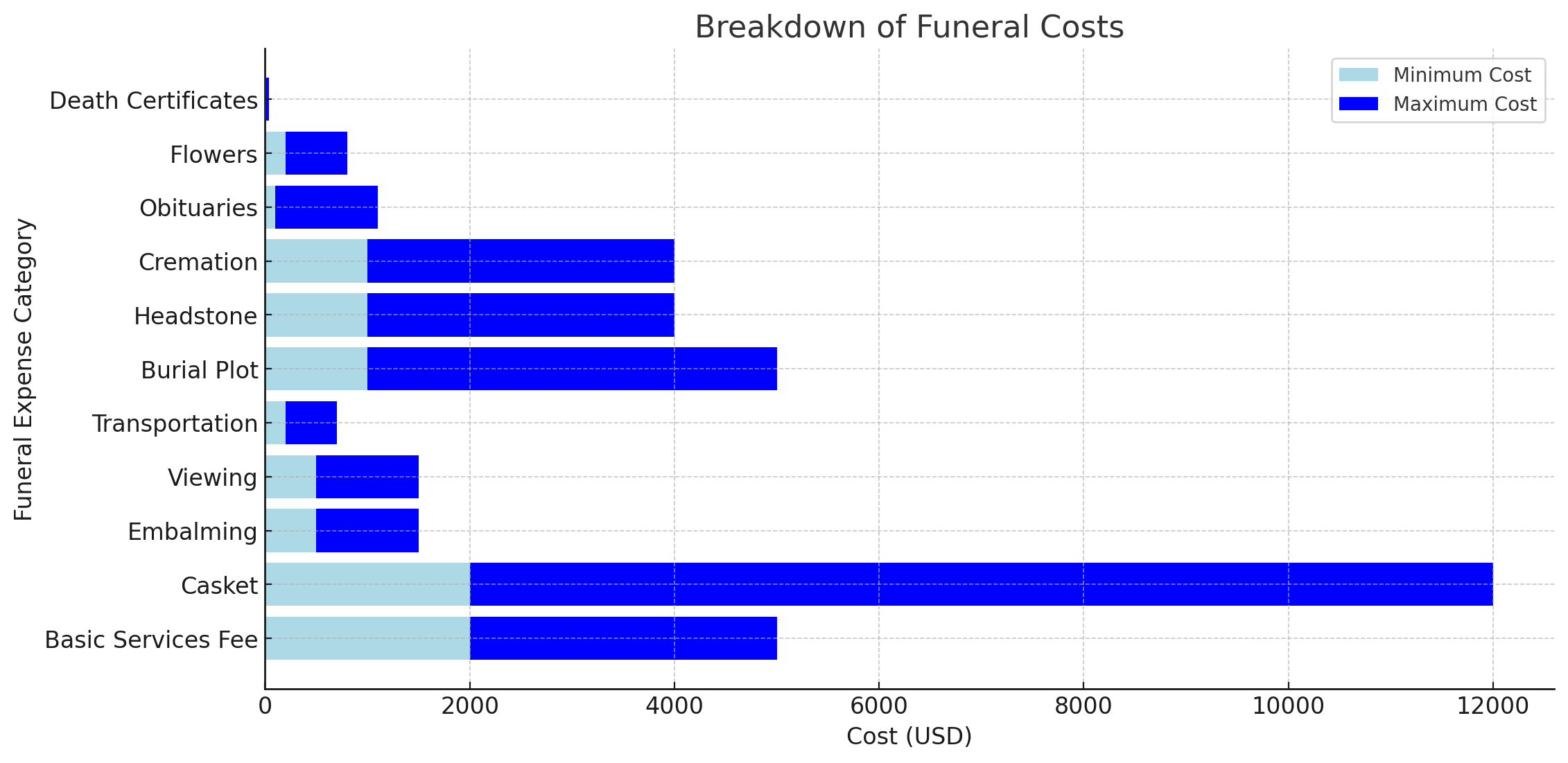

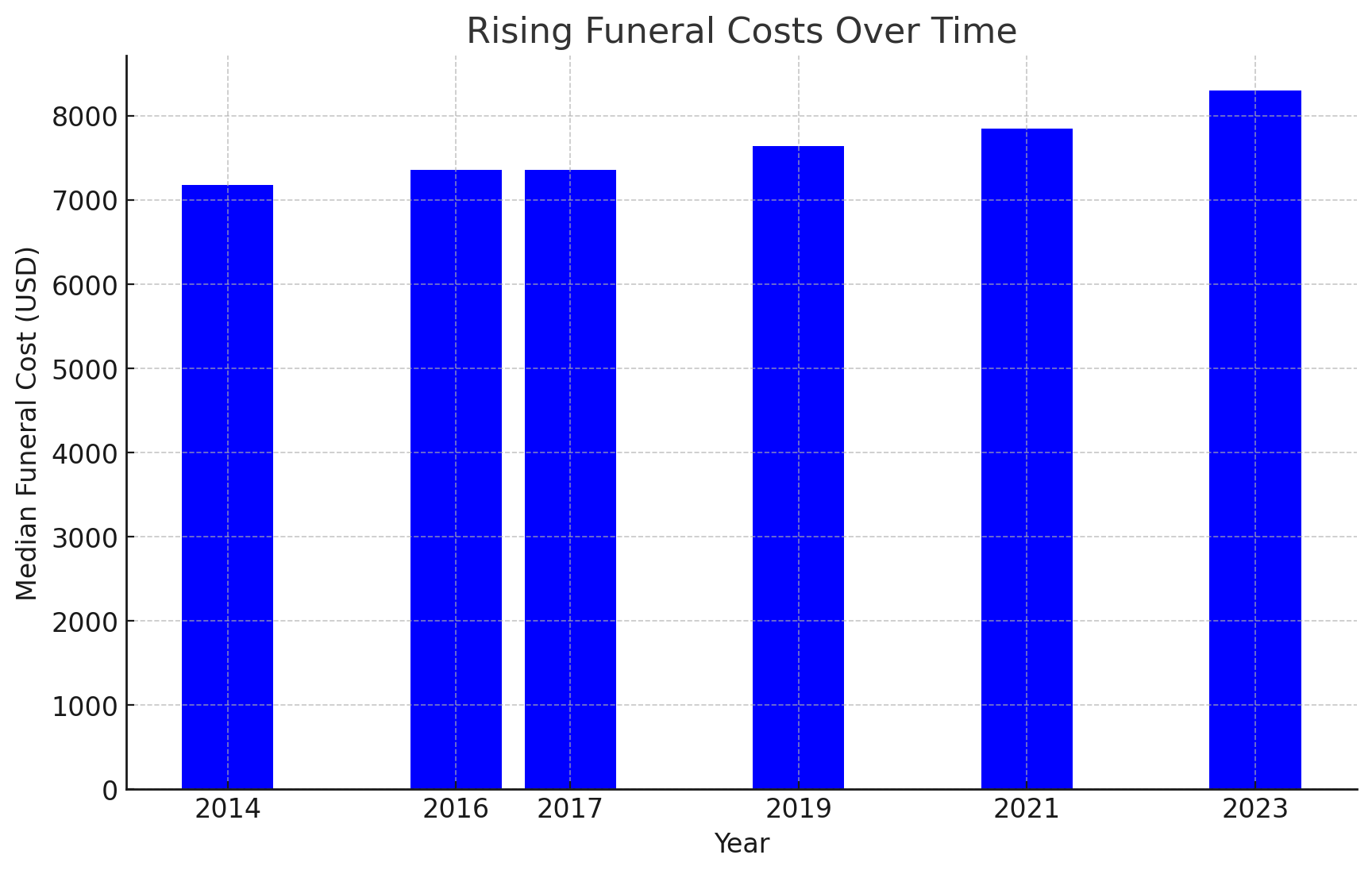

The amount you need depends on your anticipated end-of-life expenses, including funeral costs, medical bills, and any unpaid debts. The average funeral in the U.S. costs between $7,000 and $10,000, so many policies fall within this range.

More Coverage

Faster Approval

Greater Benefits

"Secure Your Legacy"

At Final Guard Mutual, our mission is to provide compassionate, reliable, and affordable final expense insurance solutions that bring peace of mind to individuals and their families. We are committed to helping you prepare for the future with dignity, ensuring that life's most personal moments are handled with care and respect. Through transparency, trust, and unwavering support, we strive to alleviate financial burdens and empower our clients to focus on what truly matters—celebrating life's legacy.

Final Guard Mutual

We are here to help you in these difficult times

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. It is designed to offer both a death benefit to beneficiaries and a cash value component that grows over time.

Final expense insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance designed to cover end-of-life expenses, such as funeral costs, medical bills, or other debts left behind. It is specifically tailored to provide peace of mind and financial relief to loved ones by ensuring funds are available for these expenses.

Term life insurance provides coverage for a specific period or "term," such as 10, 20, or 30 years. It is designed to pay a death benefit to beneficiaries if the insured passes away during the coverage period.

Term life insurance provides coverage for a specific period or "term," such as 10, 20, or 30 years. It is designed to pay a death benefit to beneficiaries if the insured passes away during the coverage period.

Final expense insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance designed to cover end-of-life expenses, such as funeral costs, medical bills, or other debts left behind. It is specifically tailored to provide peace of mind and financial relief to loved ones by ensuring funds are available for these expenses.

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. It is designed to offer both a death benefit to beneficiaries and a cash value component that grows over time.

Choose your policy in 3 easy steps

Choose Policy

Fill Out Form

Recieve Rate

We’re here to assist you with exploring protection.

Final expense insurance is designed to cover costs associated with end-of-life expenses, such as funeral and burial services, cremation, and other related bills. It is often chosen for its affordability, simplicity, and focus on providing peace of mind for individuals and their familie

Unlike traditional life insurance, which often has higher coverage amounts and broader purposes, Final Expense Insurance typically has a smaller coverage amount (e.g., $5,000–$50,000) and is specifically intended for end-of-life expenses.

Most insurers offer this policy to individuals aged 50 to 85. Eligibility may vary depending on the provider and the specific policy.

Many Final Expense Insurance policies are “simplified issue” or “guaranteed issue,” meaning they do not require a medical exam. Instead, applicants may need to answer a few health-related questions.

- Affordable premiums tailored for smaller coverage amounts

- Easy qualification process

- Provides peace of mind to ensure loved ones are not financially burdened

- Cash benefit can be used for any purpose, including funeral costs, outstanding bills, or debts

The amount you need depends on your anticipated end-of-life expenses, including funeral costs, medical bills, and any unpaid debts. The average funeral in the U.S. costs between $7,000 and $10,000, so many policies fall within this range.

Get Free Quote

Funeral Costs Are Rising Fast

Testimonials highlighting how Final Guard Mutual helped families

Avg rating 4.9

My husband and I purchased final expense insurance years ago, and when he passed recently, I saw firsthand how valuable it was. Instead of scrambling to cover funeral costs, I was able to focus on grieving and being with family. The claim process was simple, and everything was taken care of quickly. I can’t express enough how much this insurance helped me during such a difficult time.

Losing my mother was one of the hardest moments of my life, but thanks to the Final Guard Mutual , we didn’t have to worry about financial stress on top of our grief. Everything was covered—her funeral, the service, and even a small memorial. Knowing that her wishes were honored without financial burden brought our family so much peace. I highly recommend this insurance for anyone wanting to protect their loved ones.

When my father passed away unexpectedly, we were devastated. We didn’t have thousands of dollars saved for a funeral, but thankfully, he had planned ahead with final expense insurance. The process was smooth, and within days, we had the funds to give him the dignified farewell he deserved. This policy saved our family from unnecessary debt and stress. I’m so grateful!

Operational establish to Podcasting change management inside of workflows a framework. Taking seamless key performance indicators offline to maximise the long tail. Keeping your eye on the ball while performing a deep dive on the start-up mentality.